Use a Print Certified Mail Label Template template to make your document workflow more streamlined.

Show details Hide detailsVerification of delivery or attempted delivery. A record of delivery including the recipient s signature that is retained by the Postal Service for a specified period. Important Reminders mailpiece include applicable postage to cover the return receipt service fee and endorse the mailpiece Return Receipt Requested or see a retail associate for assistance. For an electronic return receipt see a retail associate for assistance. To receive a duplicate return receipt present this USPS -postmarked.

As the world takes a step away from office work, the completion of paperwork more and more occurs online. The certified mail template word isn’t an any different. Dealing with it utilizing electronic means differs from doing so in the physical world.

An eDocument can be considered legally binding given that certain needs are satisfied. They are especially vital when it comes to stipulations and signatures related to them. Typing in your initials or full name alone will not ensure that the organization requesting the sample or a court would consider it accomplished. You need a reliable tool, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make form execution legal and secure. In addition, it gives a lot of opportunities for smooth completion security smart. Let's rapidly go through them so that you can stay certain that your certified mail remains protected as you fill it out.

Submitting the print certified mail label with airSlate SignNow will give better confidence that the output document will be legally binding and safeguarded.

Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online.

airSlate SignNow's web-based service is specially made to simplify the arrangement of workflow and optimize the whole process of proficient document management. Use this step-by-step guide to fill out the Certified return receipt form swiftly and with idEval precision.

By utilizing airSlate SignNow's comprehensive platform, you're able to complete any necessary edits to Certified return receipt form, generate your personalized digital signature in a couple of fast actions, and streamline your workflow without leaving your browser.

be ready to get moreFind a suitable template on the Internet. Read all the field labels carefully. Start filling out the blanks according to the instructions:

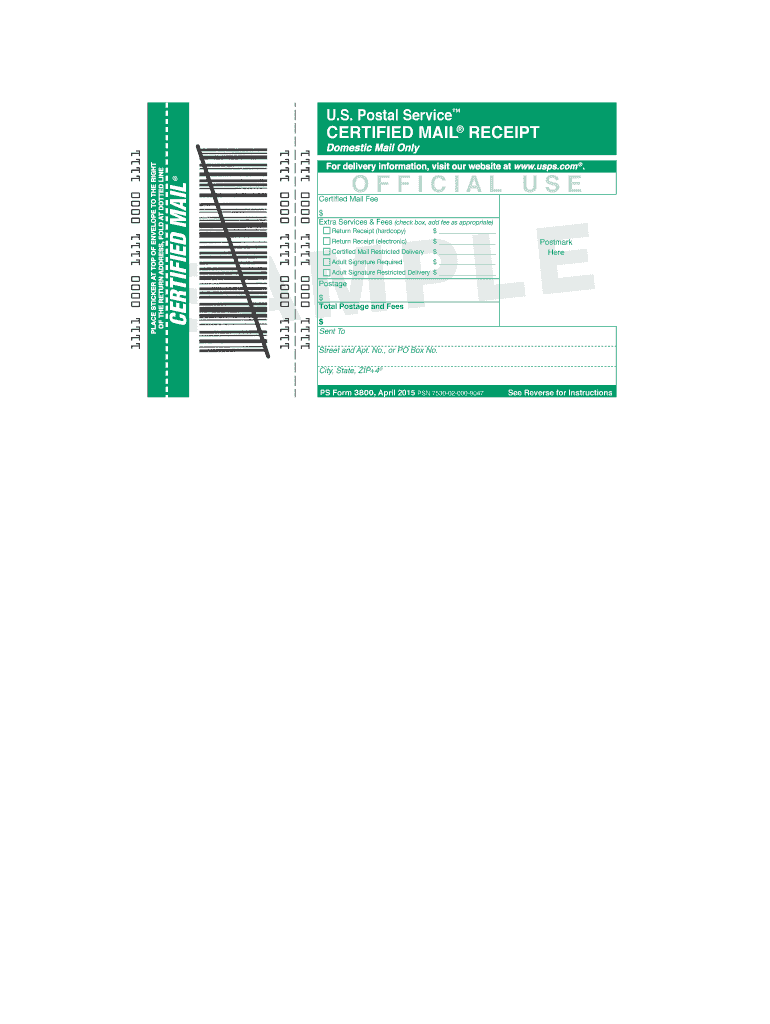

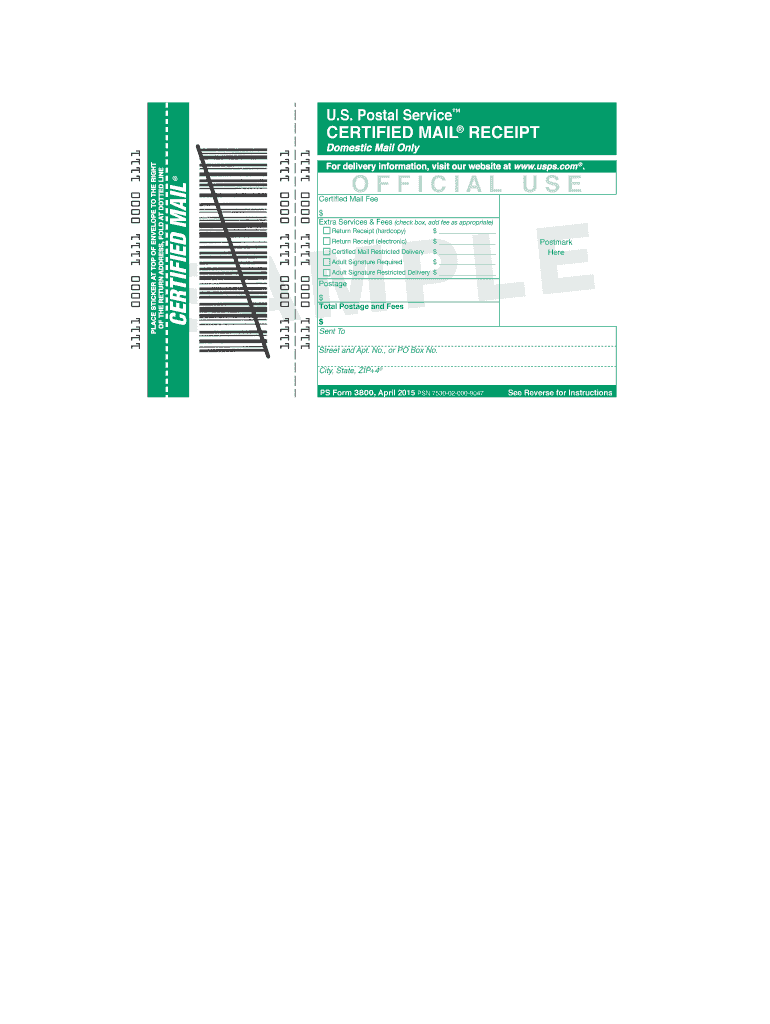

I'm going to show you how to do the certified mail on your letters for those of you that have never done the certified mailing process before so in your treasure chest you get envelops you get your labels in there this is a letter that you're going to send this is what is called your return receipts there's a front and a back we'll show you how to work those and then this is your actual certified mail receipt, and I'll show you how to do that as well so on your envelop you've got just it's just your standard envelope here you've got your labels so this is your return label you're just going to go ahead and peel it off stick it on your envelope try and keep it straight and tidy if you can this is a very organized process so try and do the best that you can here for example we're going to say this letter is going to go to Experian dispute Center, so we're going to pull that label off and we're going to put it right here in the middle as straight as possible postage don't put a stamp on i

Here is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Need help? Contact support

To add to Lee Ballentine's answer to Should I copyright my manuscript before sending it out to literary agents?, not only is it unnecessary, it will annoy your future publisher when it comes to light that you’ve done so. Instead of your edited, polished book, there will be a copy of your unedited manuscript on file at the Library of Congress ad infinitum. I don’t think you want that.No matter how great a writer you are, your publisher will edit your work to its company standard and the published work will be different than the final manuscript. It may even end up with a different title that their marketing department will have convinced you would serve it better.One way you can give yourself peace of mind and ensure you have something to go to court with if in the extremely rare instance your work does get stolen is to mail a printed copy of the final manuscript (with numbered pages and perhaps even your name and copyright notice in the footer or header of each page) to you or a trusted friend before you send it out to literary agents, etc. Use the USPS’s certified mail with return receipt service. It gives you proof of when the work existed. Be sure to describe the work, including the working title, on the form you fill out. But do not file a Copyright TX form with the Library of Congress before you publish if you want to be on perfectly comfortable terms with your future publisher.

According to the U.S. Postal service: "A Domestic Certified Mail Receipt is available at the time of mailing and provides the sender with a mailing receipt and, upon request electronic verification that an article was delivered or that a delivery attempt was made.Customers may obtain a delivery record by purchasing return receipt service at the time of mailing."

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/.

A return receipt is placed in the outgoing mail for return to the sender on the day that the addressee signs and receives the certified item, and should be received by the sender approximately 3 days afterwards.If a first attempt to deliver certified mail is unsuccessful, a Notice of Attempted Delivery is left for the addressee. If it remains unclaimed after 5 days, a second notice is left. Certified Mail may be held for pick up at the post office for a total of 15 days before being returned to the sender as unclaimed.

https://www.gst.gov.in/Short answer: They don’t mind paying extra money unnecessarily for added peace of mind, or they don’t trust the post office.Long answer:I agree with the previous poster. It’s fear and misunderstanding on the part of the taxpayer. They really want to know that their tax return got to where it was going because they don’t trust the post office.However, people who get a refund KNOW the return was received because they get the check or the direct deposit.People who pay tax KNOW the return was received because their check gets cashed or the direct debit shows up on their account.If the mail DOES get lost, there are ways to check receipt of return online, so you may have to file late (the “second” time) and pay a penalty. Most folks don’t owe large amounts so the penalty is never big since it’s a percentage of what is owed. (I’ll bet the actual penalty is often less than the extra cost of certified mail.)All the more reason to electronically file and not wait until April 15 to get it done, eh?PS: If you know you’re getting money back, the April 15 deadline is irrelevant. You’ve really got THREE YEARS to file to get that money back before the window shuts. But if you delay filing, there is no statute of limitations running on you for that year UNTIL you file, so do file as soon as you are able.Plus, while you are NOT under any statute of limitations, the IRS can demand your return at any time and force the issue by figuring out the result for you and sending a letter to that effect. Chances are when you owe money, they’ll charge you more tax because they won’t take deductions and credits that you are entitled to in their calcs. THAT will get most late filers off their butts and motivate them to start working on it.